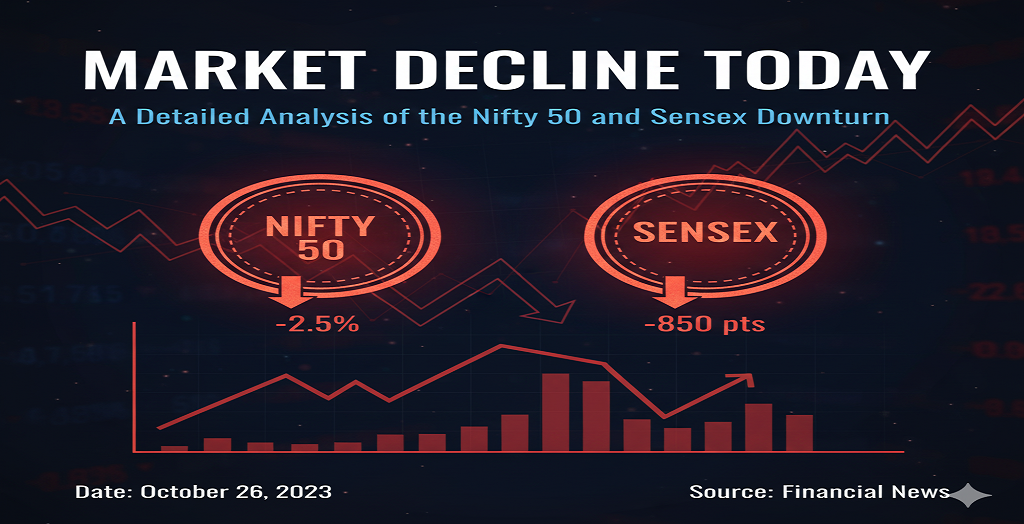

The Indian stock market witnessed a notable decline today, with both the Nifty 50 and Sensex closing significantly lower. Such sudden market movements often raise concerns among investors, traders, and analysts who try to identify the triggers behind the volatility. While short-term corrections are a natural part of market cycles, understanding the factors that influence these declines helps investors stay informed and make rational decisions.

In today’s analysis, we explore the key reasons behind the downturn, global and domestic cues affecting investor sentiment, sector-wise performance, and what market participants can expect in the coming days.

1. Overview of Today’s Market Performance

The benchmark indices opened on a weak note and continued to slip throughout the day. The Sensex fell sharply, losing several hundred points, while the Nifty 50 followed a similar downward trajectory. The decline was broad-based, with major sectors such as banking, IT, energy, and FMCG contributing to the fall.

Market experts noted that the selling pressure intensified during the afternoon session, driven by weak global cues and cautious domestic sentiment. Despite a few pockets of resilience, the overall market mood remained bearish.

2. Global Factors Behind the Market Decline

Global markets have a direct impact on India’s financial ecosystem, and today’s downturn was heavily influenced by international developments. Some major global factors include:

a. Weakness in US and European Markets

Overnight losses in major US indices such as the Dow Jones, NASDAQ, and S&P 500 triggered nervousness among global investors. Concerns over prolonged high interest rates and slowing economic growth created a risk-off mood.

European markets also opened lower amid geopolitical tensions and energy-related concerns.

b. Rising US Bond Yields

The steady rise in US treasury yields is a major factor behind foreign investors withdrawing money from emerging markets like India. Higher yields abroad make US assets more attractive, prompting foreign institutional investors (FIIs) to reduce exposure in riskier markets.

c. Global Crude Oil Price Volatility

Fluctuations in global crude oil prices continue to affect India’s market because higher oil prices worsen inflation and increase import bills. Any spike in crude prices often leads to pressure on sectors such as airlines, transport, and manufacturing.

3. Domestic Factors Contributing to the Downturn

Alongside global cues, several domestic issues added to the market pressure:

a. Profit Booking

After a strong rally over the past few weeks, many investors chose to book profits. This naturally led to a market correction. Profit booking is common after markets touch new highs or show prolonged bullish momentum.

b. Inflation Concerns

Rising inflation remains a concern for the Indian economy. Elevated food prices, higher commodity rates, and supply-chain issues add pressure on inflation metrics. When inflation stays high, the Reserve Bank of India (RBI) may delay rate cuts, which affects market sentiment.

c. FII Selling

Foreign institutional investors continued their selling spree today. Persistent outflows create downward pressure on benchmark indices. Meanwhile, domestic institutional investors (DIIs) attempted to provide support but couldn’t fully offset the sell-off.

d. Quarterly Earnings Disappointments

A few major companies reported weaker-than-expected quarterly results. Earnings disappointment tends to drag down sector indices and creates a negative environment across the broader market.

4. Sector-Wise Breakdown of Today’s Decline

The decline in Sensex and Nifty 50 was not restricted to a single sector. Almost all major segments witnessed selling pressure.

a. Banking and Financials

Banking stocks were among the biggest losers as concerns over loan growth, NPA levels, and interest rate uncertainty weighed heavily on the sector.

b. IT Sector

IT stocks slipped due to concerns over global recessionary trends and reduced tech spending by US and European clients.

c. Auto Sector

Auto companies faced pressure as rising input costs and weaker demand outlook affected sentiment.

d. Energy and Oil & Gas

Energy companies witnessed volatility due to fluctuating crude oil prices and concerns about global supply disruptions.

e. FMCG

Even defensive sectors like FMCG experienced mild selling as investor confidence wavered across the market.

5. Investor Sentiment and Market Psychology

Market behavior is driven not only by economic data but also by emotion and perception. Today’s decline highlights several key aspects of investor psychology:

a. Fear-Based Selling

When markets fall, retail investors often panic and sell, amplifying the decline.

b. Herd Behavior

Investors tend to follow what others are doing—if FIIs sell heavily, domestic traders often replicate that behavior.

c. Cautious Approach Ahead of Major Events

Investors turn conservative ahead of major events like RBI policy meetings, budget announcements, or global economic releases.

6. What Does This Downturn Mean for Investors?

Short-term volatility is normal in stock markets. Instead of panicking, investors should focus on fundamentals and long-term trends.

Key Takeaways for Investors:

-

Short-term declines are opportunities for long-term investors to accumulate quality stocks.

-

Diversification is essential to manage risk during volatile periods.

-

Avoid emotional selling—market corrections are temporary.

-

Monitor global cues, especially US markets, crude prices, and bond yields.

-

Stay updated on quarterly earnings, as they directly influence index movement.

7. What to Expect in the Coming Days?

Market experts believe that volatility may continue in the short term due to global uncertainties and domestic inflation challenges. However, India’s long-term economic outlook remains strong, supported by growing consumption, policy reforms, and corporate growth.

If global cues stabilize and inflation eases, markets could witness a rebound. Much will also depend on upcoming corporate earnings and foreign investor activity.

Conclusion

The decline in the Nifty 50 and Sensex today was the result of a combination of global uncertainties, domestic concerns, sector-specific pressures, and investor sentiment. While short-term corrections may seem worrying, they are a normal part of market movement. For long-term investors, this downturn can serve as a strategic moment to review portfolios and accumulate fundamentally strong stocks.

Staying informed, avoiding panic, and focusing on long-term financial goals are the keys to navigating periods of market volatility.